As we march towards 2024, the adoption of smart meters across the globe presents a vivid tableau of technological evolution and its integration into our daily lives. The smart meter, a cornerstone in the burgeoning Internet of Things (IoT) landscape, has transcended its role as a mere utility measurement device to become a key player in the digitalization of utility services worldwide.

The Global Pulse on Smart Meter Adoption

By the close of 2023, the world witnessed the monumental installation of over 1.06 billion smart meters, encompassing electricity, water, and gas meters, according to IoT Analytics’ “Global Smart Meter Market Tracker 2020-2030”. This milestone not only signifies a leap towards digitalizing distribution infrastructures but also highlights the pivotal role smart meters play in leveraging near-real-time data for utilities across the globe.

North America, leading the charge, boasts the most mature smart meter market with an electric meter penetration nearing 77%. The technology adoption in Latin America significantly lags, while certain EU countries and regions in East Asia exhibit high penetration rates. South Asia, Latin America, and Africa are identified as regions with high growth potential, driven by government initiatives aimed at modernizing aging electrical grid infrastructures and fostering regulatory policies to encourage smart meter deployment.

Why This Matters

Understanding the growth potential within the global and regional smart meter markets is crucial for OEMs, suppliers, and providers within the smart meter value chain. Identifying opportunities for new device deployments and project investments can significantly impact strategic planning and market positioning.

The updated "Global Smart Meter Market Tracker 2020-2030" by IoT Analytics paints a picture of a future where over 1.75 billion smart devices are installed by 2030, marking a 6% CAGR. This surge is underpinned by the utility sector's growing focus on sustainability and digitalization, positioning the smart meter market as one to watch closely.

The present adoption rates for smart electricity meters far exceed those of their gas and water counterparts. However, projections suggest a shift by 2030, with smart gas and water meters expected to grow at a CAGR of 10% and 16%, respectively.

Despite the comprehensive coverage across 52 countries and 5 regions, including metrics on installations, shipments, revenue, market penetration, and connectivity technologies, IoT Analytics plans to spotlight each smart meter sub-market, starting with electricity meters.

Global Smart Meter Market Overview

As of the end of 2023, smart electricity meters have penetrated 43% of the global meter market, a significant milestone spurred by modernization initiatives that began in Italy and the US in the late 2000s and accelerated across the EU and Asia-Pacific post-2010. Supported by regulatory policies and government financial incentives, this growth has encouraged utility companies to replace mechanical meters with smart ones, modernizing electrical grid infrastructures.

However, not all regions are modernizing at the same pace. North America, Europe, and East Asia have higher penetration rates, but adoption varies by country. Meanwhile, comprehensive smart meter projects in Latin America, Africa, and South Asia progress slowly. Despite some countries launching large-scale smart meter projects in recent years, complexities in implementation, lack of regulatory policies, and cost barriers have delayed broader adoption.

Overall, the outlook for the smart meter market is positive, with projections indicating that these IoT devices will account for 54% of the global meter market by 2030.

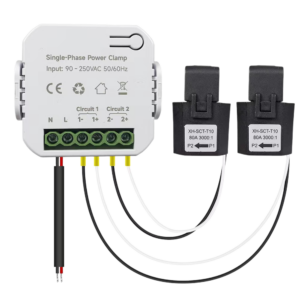

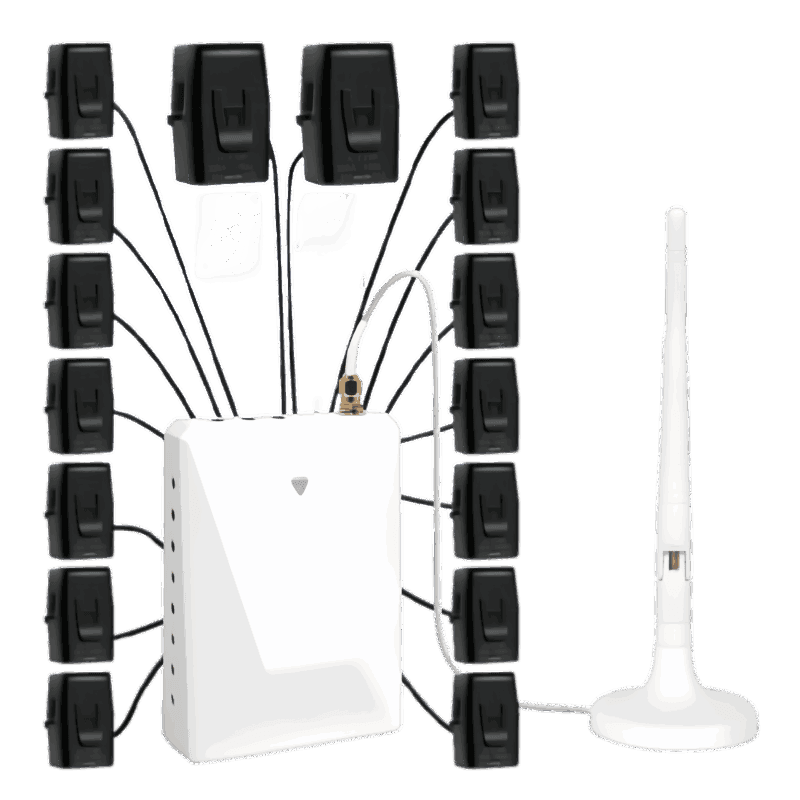

Smart Meter Definitions

A smart meter is an electronic IoT device used in utility service providers' (USPs) metering systems to measure various parameters as electricity is distributed to consumers. Part of a USP's Advanced Metering Infrastructure (AMI), smart meters facilitate two-way communication, allowing utility front-end systems to collect data and communicate with the meters, providing near-real-time insights on energy quality, voltage fluctuations, and outages in the USP's distribution infrastructure.

Smart Meter Market and Regional Adoption

While country-level market data offers granular insights, here’s a glimpse into the regional landscape of smart meter adoption:

- North America leads in smart meter adoption, with a penetration rate nearing 77% by the end of 2023.

- Asia-Pacific holds the second most mature market, driven by nationwide deployments in China and Japan.

- Europe ranks third, showcasing varied adoption rates across countries.

- Middle East and Africa see leaders in Saudi Arabia and the UAE pushing forward with implementation.

- Latin America lags in deployment, primarily due to regulatory hesitations delaying project launches.

Analyst Outlook on the Power Smart Meter Market

While mature markets in North America, Europe, and East Asia exhibit saturation, regions like South Asia, Latin America, and Africa represent untapped growth potential. Key considerations for stakeholders include market saturation in developed economies, cost sensitivities in emerging markets, supply chain diversification, and the uncertainties of regulatory policies. Future innovations and market trends, including IC, edge computing, and TinyML innovations within second-generation smart meters, promise to alleviate network pressures, enhance real-time grid response, bolster resilience, and improve data security and privacy.

This comprehensive analysis underscores the transformative journey of the smart meter market, from a pivotal component in utility modernization efforts to a cornerstone of the global IoT ecosystem. As the landscape evolves, so too will the opportunities for innovation, investment, and engagement across the smart meter value chain.